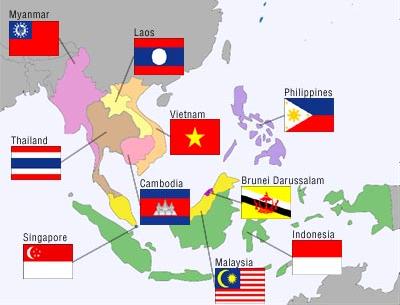

Photo source: http://theasiacareertimes.com/wp-content/uploads/2011/07/asean.jpg

The formation of the ASEAN Economic Community (AEC) is one of the most significant issues nowadays but also the least discussed. When fully implemented in 2015, it is expected to transform the economic environment in the region. The design for the region as a single market and production base is presented in the document entitled ASEAN Economic Community Blueprint approved by the ASEAN heads of states in 2007. The blueprint has five core elements and general features such as:

- free flow of goods, which will be done through the elimination of tariffs;

- free flow of services, allowing companies to supply services across national borders within the region;

- free flow of investment, allow infusion in specific industries;

- free flow of capital, lower restrictions on foreign direct investments;

- free flow of skilled labor, allowing professionals to practice their profession within the region.

One of the main questions is the impact of the integration in the microfinance industry in the region. Will it facilitate credit access to more marginalized sectors or will it be sidelined in the process? Presently, the microfinance sectors in various countries are in various stages of development. Consider the following:

- In the Philippines, the initial public offering (IPO) of the AG Finance was approved by the Securities and Exchange Commission (SEC), the first ever in the country. The draft guidelines for NGO-MFIs was also released for comments, strengthening the legal framework for the industry with providers that includes banks and cooperatives;

- In Cambodia, PRASAC, the biggest MFI is in the process of transforming into a bank, following the steps of ACLEDA, the country’s biggest bank that started also as an NGO-MFI. Other big MFIs are also poised to follow the same route as the country’s economy continue its upward trend;

- Vietnam is moving cautiously as it continue to develop the legal framework for microfinance. With government banks also involved in the provision of microfinance services, the role and participation of non-government institutions are slowly and stringently being studied;

- Myanmar is fast in catching up as it develops the legal framework for microfinance operations. Provision of microfinance services is currently through existing NGO-MFIs and the cooperative sector. In related development, ACLEDA of Cambodia was supported by the International Finance Corporation (IFC) to set up microfinance operations in the country.

Definitely, the microfinance sector will be affected by the economic integration as each country is in different levels of development. Are we going to see MFIs crossing national boundaries? Or will the commercial MFIs lord it over the non-stock, not-for-profit MFIs? Will there be harmonization of laws on microfinance? These questions have to be answered as the microfinance sector responds to the effects of economies going south.

Another question is the social cost of integration. As goods and products from other countries flow in, production and income of local companies with the same products will be affected. Closure of small enterprises will mean laying off people dependent on these enterprises. The question is, will the integration bring about opportunities for the local producers to develop capacity to enhance its products, or will it stunt the growth of local companies as more efficient suppliers from other developed countries are coming in.

As more questions need more definite answers, the ASEAN Secretariat and the respective governments of the member-countries should facilitate dialogues and information campaign to enlighten the people about the impact of the integration. In same light, the people should also take initiatives to learn about the issue and be ready when it is implemented.